Best Of The Best Tips About How To Appeal And Grieve Your Taxes In Suffolk County

Ad as heard on cnn.

How to appeal and grieve your taxes in suffolk county. How can i learn more about my assessment? Welcome to the suffolk county clerk's office. File the grievance form with the assessor or the board of assessment review (bar) in your city or town.

Free tax analysis & consultation! At one time or another either directly or indirectly, every resident of suffolk county deals with our office. The property tax appeal process explained.

Speak with a real estate tax assessment consultant today. (c) any taxpayer entitled to appeal to the tax tribunal pursuant to subsection (a) above shall commence an appeal by filing a notice of appeal with the tax tribunal. Taxes in suffolk, virginia are 26.5% more expensive than montgomery, alabama.

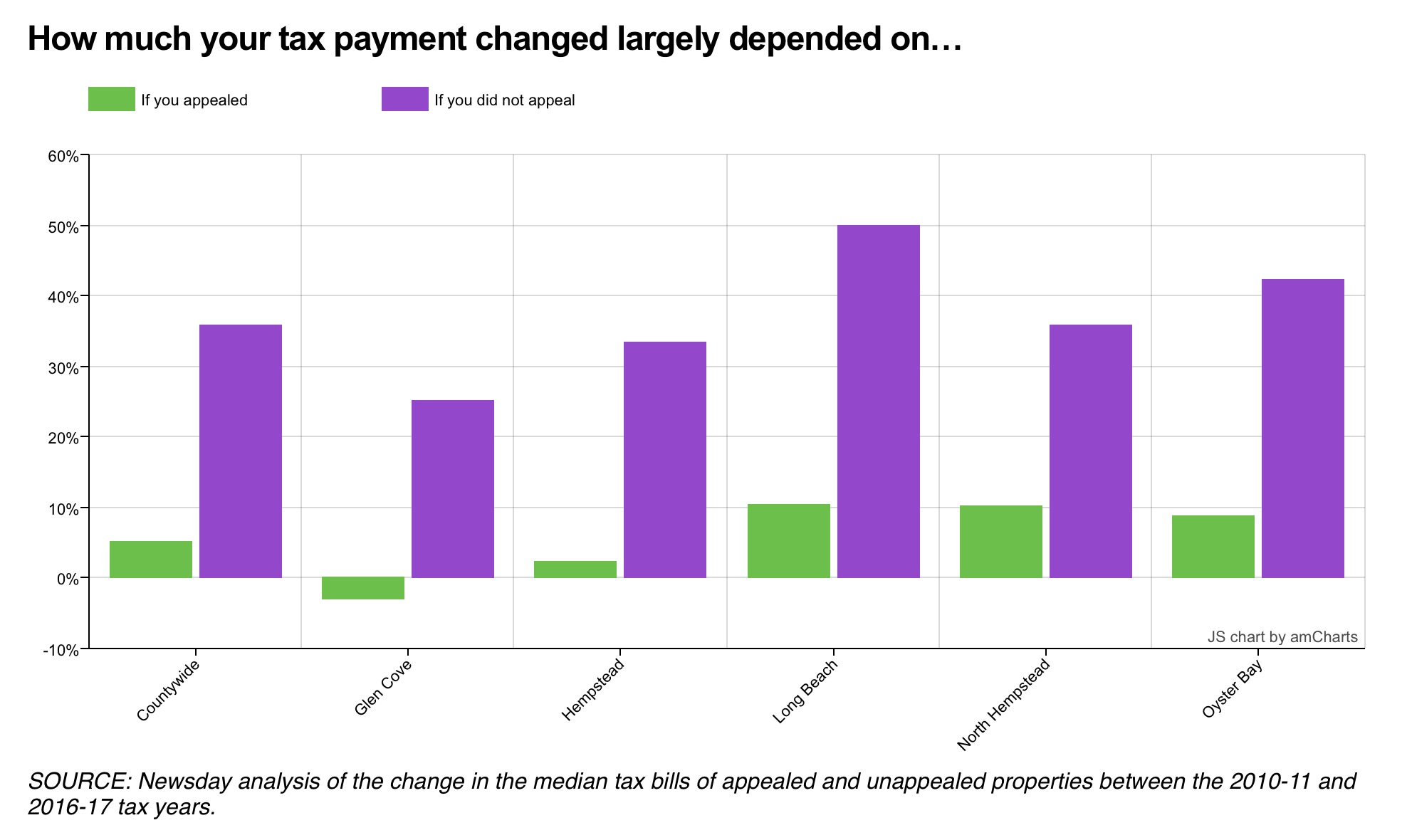

In suffolk county, the initial appeal is handled by the board of assessment review (boar). Between january 4, 2021 and march 1, 2021 you may appeal online. Suffolk properties are assessed by each town.

So if you are buying a home, satisfying. We can answer any questions you have, and get you. If your property is located in a village that assesses property, you will have.

Decide if a property tax appeal is worth your. Free tax analysis & consultation! Local governments periodically assess all the real estate they tax.