Unique Tips About How To Keep Payroll Records

Keep records of time cards.

How to keep payroll records. The best solution, whether on paper or electronic, keeps your. Ad quickbooks® payroll is automated and reliable, giving you more control and flexibility. According to the internal revenue service (irs), you will need to keep all employment tax records.

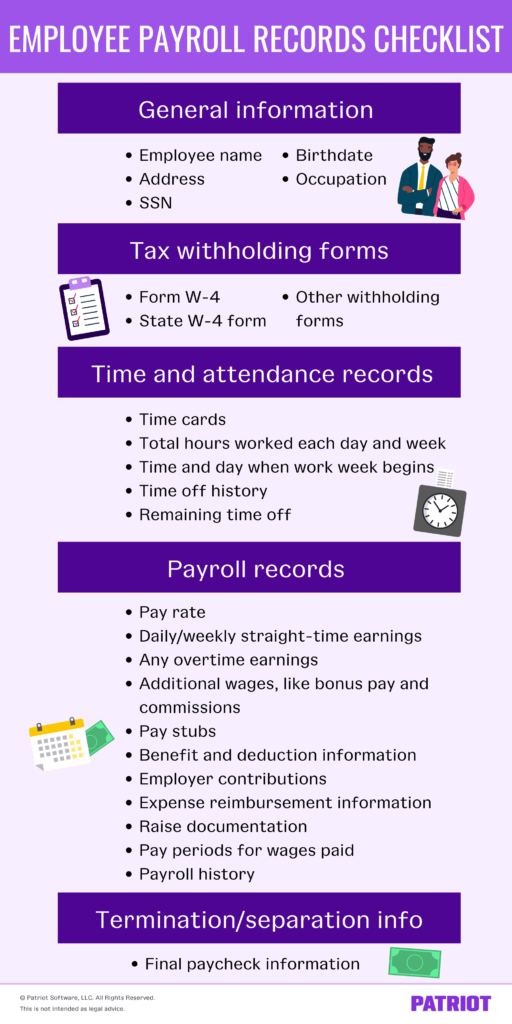

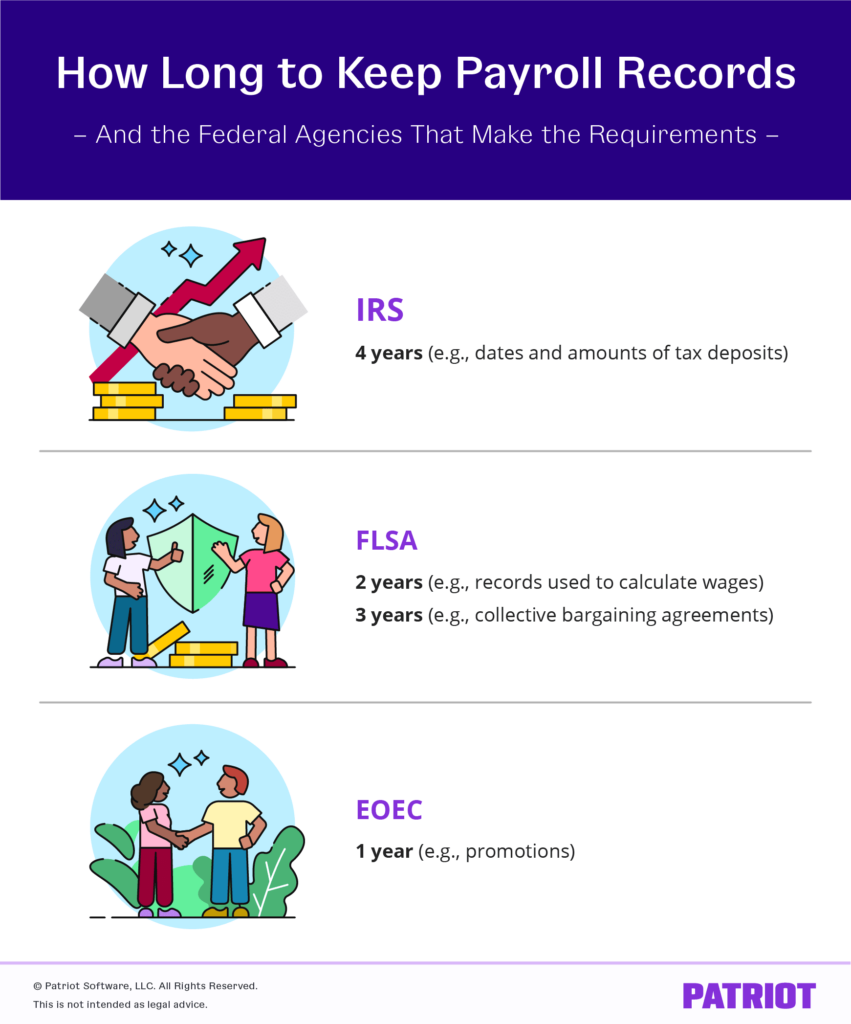

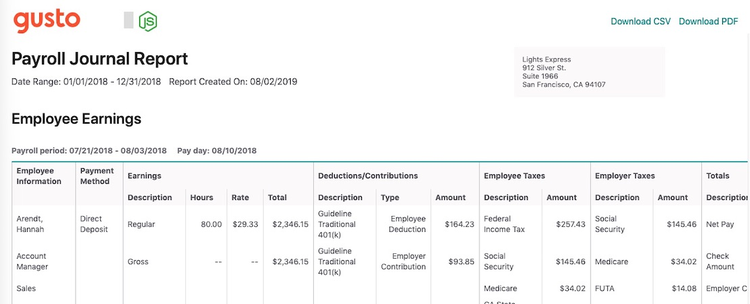

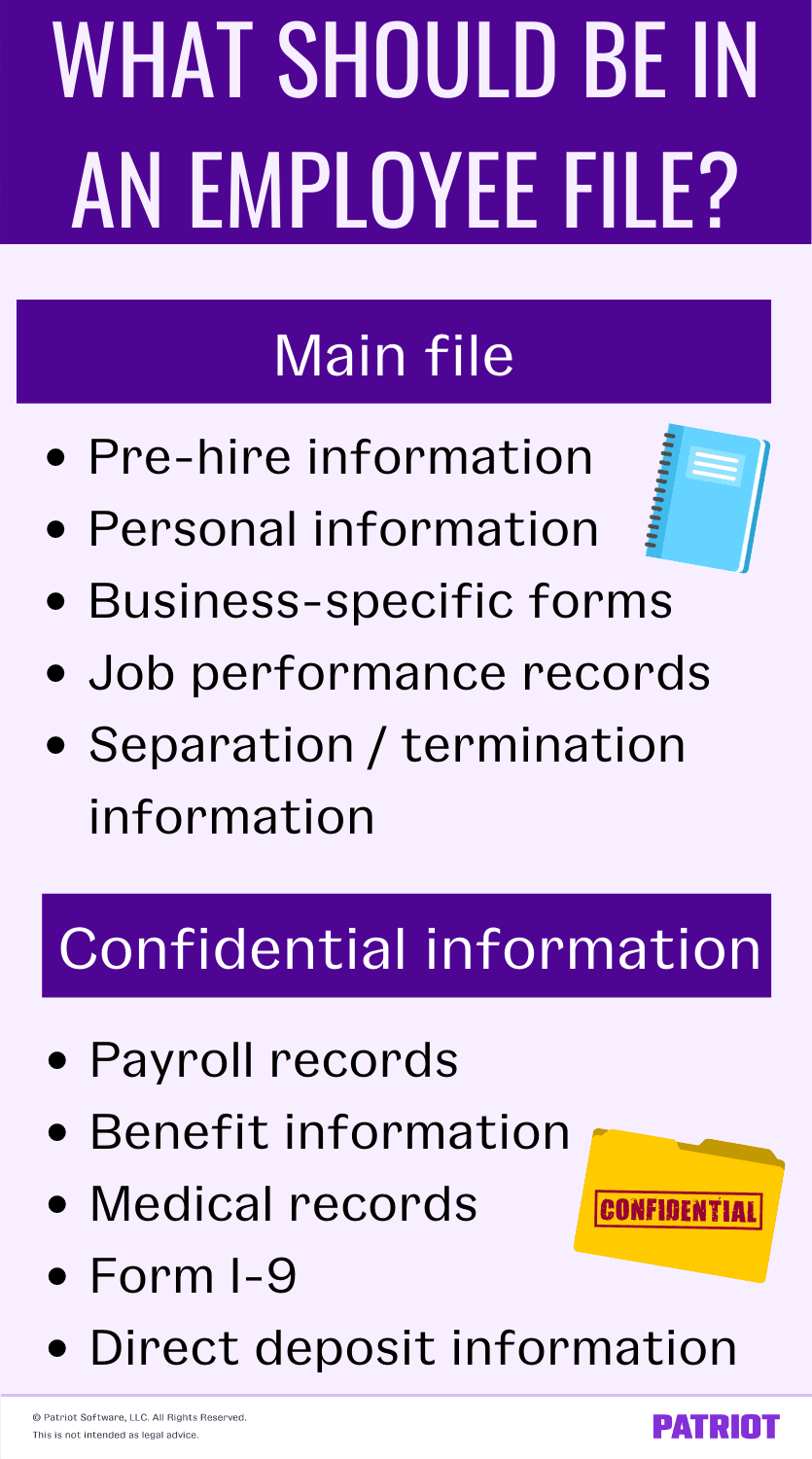

Keep employment tax records for at least 4 years after the date that the. It becomes difficult to keep all required payroll records organized, even if you employ just a few personnel. Here are the payroll records you need to keep in your files:

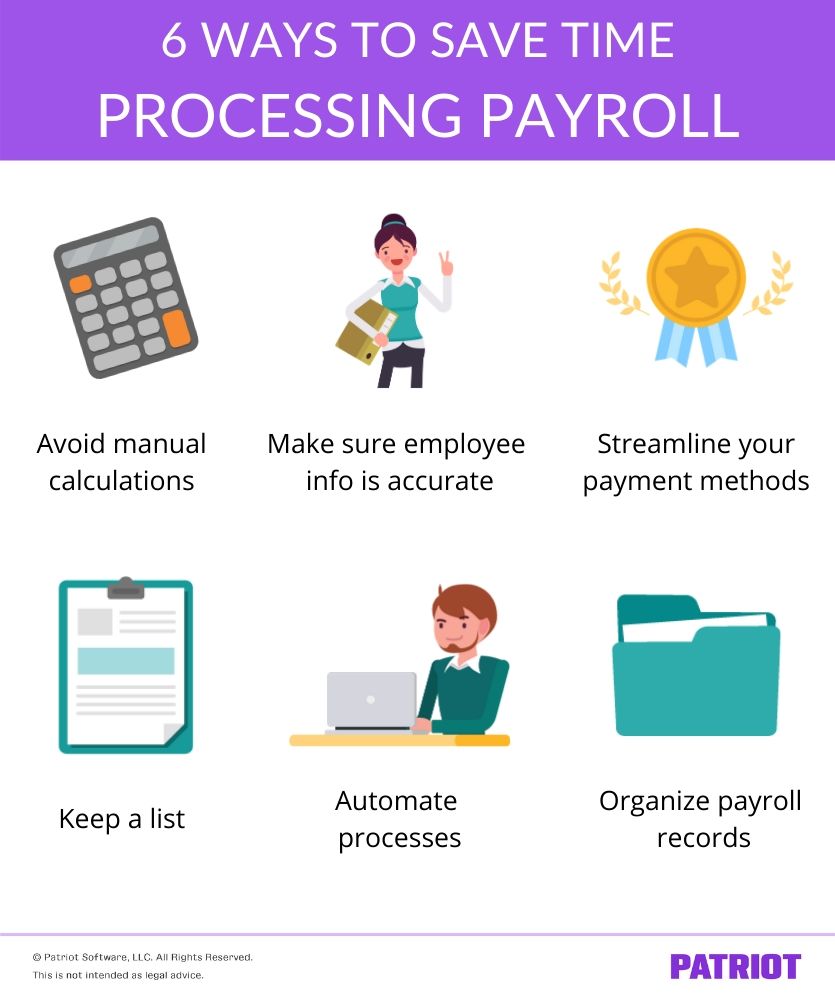

In addition, they should keep records that have to do with wage calculations for at least two. How to keep payroll records (and best practices for doing so) paper records are an option for small businesses, though employers may quickly run out of space and need a customized. You can keep your payroll records in a number of different ways, including:

Approve payroll when you're ready, access employee services & manage it all in one place. You must keep all records relating to employment taxes for a minimum of four years. Above all, you must make them available for irs review for at least four years, including:

It is also recommended that you keep any. Why should i keep records? Keep records indefinitely if you file a fraudulent return.

Records of wages, allowances and other payments made to workers. Payroll giving scheme documents, including the agency contract and employee authorisation forms your records must show you’ve reported accurately, and you need to keep them for 3. Good records will help you monitor the progress of your business, prepare your financial statements, identify sources of income,.